View the meeting (click to open)

Water update:

The new pump was installed on Well #4 and seems to be doing ok. There's no word on why the well failed, but it's at least under warrantee.

Municipal Liquor Store suggestion:

There was a suggestion by staff that the city of Dayton create a municipal liquor store. Three of the members requested more information on it. I have no interest in it. I don't believe goverment should be in the business of running businesses.

Cubes wanting permission to work 22 hours a day on their facility.

If they were away from a residential area I'd be fine with it, but they're not. That was an easy no.

Item F (RFP for Fire Study update)

In 2019 the city funded a study to look at the state of our 2 fire stations and suggestions for the future. All of us on the council at that time became very familiar with the study results. Most of the station upgrades were funded. The study concluded in the final build out the city would need 2 stations; 1 somewhere around 117th and another around mid North Diamond Lake road. Since that's nowhere near where they are at now, it will require a staged approach. I don't think there was any disagreement on the final solution, but there was significant disagreement on the timeline. The study focused on a solution without regard to outside factors. The council's job is to pay attention to those factors. A significant one is the current debt the city has... at $16M, it's significant. A new station is estimated at $8M, but estimates on facilities tend to be low. Throw in needed provisions and another fire engine (though the study indicated we should NOT be looking at a ladder truck anytime soon, it's constantly being pushed) at around $1.7M. So I'm guessing the actual cost will be anywhere from $10M-$12M.

Additionally, there's a push to add a water treatment facility to the old village area (which would NOT be my solution) at what sounds like anywhere from $2M - $4M. and a push to purchase a large park which is going to be around $3M.

That's a lot of debt.

In the mid 2000's, this city took on a very similar massive debt, assuming housing would continue. That assumption failed and the debt nearly bankrupted the city. We're still paying dearly for that mistake.

Currently all of that debt would be paid for by new housing fees. If there's a downturn, all of those payments would fall on taxes. Which means a whole lot of layoffs, reduced services, and a lot of ick.

Before I vote for any more debt (unless really hard pressed), I want to see where this economy and housing is going over the next couple of years.

So, the request by staff was to update the study. I wasn't overly impressed with the reasons and I suspect it was just to keep it out front.

Over a previous work session that study was used as a tool to tell us we clearly didn't care about lives. A case study in how NOT to make your point. The future fire station is still in the works and a new study will not change the fact that the city's facilities and faculty will grow as the community grows.

Studies can be useful, but they are often just leverage to push things in a certain direction. Ask me about our Broadband "study" sometime.

The decision by the council, for now, was to get specifics on what would be the real purpose of an additional study.

Item I (Diamond Lake Association)

This was a presentation of the association's work on removing Curly-leaf Pondweed from Diamond Lake. They received permission from the DNR to fully treat the entire lake for the last 4 years and it's clear they're making a lot of headway. The city has helped with the costs, and in my opinion it's been money well spent. The association plans on continuing smaller treatments over the foreseeable future.

Item J (Capital Partners Final Plat)

This is a development that will be built on what will be 121st and East French Lake road. It's a 250,000 SF warehouse just south of the new 2nd Graco site. They will be building 121st which will connect Brockton and East French Lake roads.

Item K (Budget)

This is a continuation of discussion on the 2023 budget. We will approve the preliminary version in September. My guess is what is approved in September is what will likely be finally approved in December. The levy cannot increase after the preliminary approval.

Keep in mind that the city has a number of sources for funding; Fees, grants, transfers, and taxes. This year we had a couple significant sources that popped up. The covid grant (all that "free" money from the feds) was about $350k. There was $600k that had been improperly moved the last 2 years to the "temp" fund that should have stayed in the capital equipment funds it came from. There was a $325k debt payment being payed out of taxes that was paid off.

In other words... there was roughly $1.25M in funds available WITHOUT raising the levy at all! Now, most of this money was one-time money which I was fine using for one-time costs (city hall upgrades, another snow plow truck, pickups, etc). Additionally, it will be used to provide some buffer in the capital funds.

With this in mind, we should be able to reduce the levy increase previously suggested. Three council members (myself, Scott, and Dave) agreed to 2%. The other 2 agreed to it, but they indicated they would have been ok with a higher number.

I'm told there's already been a lot of nonsensical comments (by a few) on Facebook about how that was "too low." Clearly those individuals have not researched what expenses we have in the budget and the other funds we had available. I also suspect those are the same individuals that have no problem borrowing a boat load of money on top of the debt we currently have.

For starters, there is a $550k upgrade to city hall, a new snow plow ($225k), 3 new pickup trucks ($150k), a bunch more goodies for public works (they do have the coolest toys), and 3 new full time hires.

Also, a former council member is claiming Dayton's taxes have always been high because of the money that was borrowed for the central sewer and water. It is unfortunate that in 6 years he never understood the budget enough to know that those debt payments do NOT come from taxes. They come from new houses. IF the economy tanks, those payments WILL move to taxes as I stated above. That would not be good for the city or our residents.

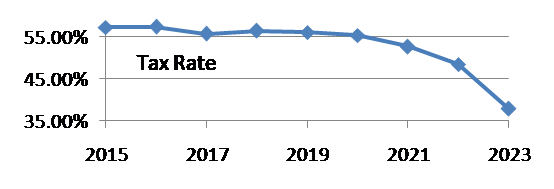

The reason this city has always had high taxes is because we've had leaders that allowed ALL of the money from the new houses (and increased value of current properties) to be spent. Had they simply spent money proportional to the new houses instead of the value of those new houses, our tax rate would have been about 40%. Unfortunately, when I became mayor we had a rate of 51.5%.

With the 7.1% increase for 2022 and what looks like 2% for 2023, that puts the tax levy at $6.6M. Our capacity from the county is looking like $17.4M. The tax rate is (roughly) calculated by dividing the levy by the capacity. That equates to 38%. We'll have more exact numbers in a couple months, but it's likely these numbers are fairly close.

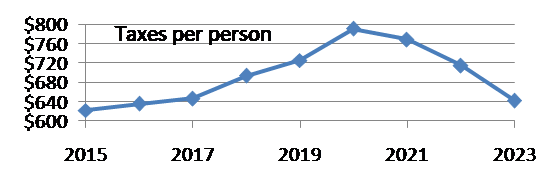

While talking about tax increases seems to contradict the concept of reducing taxes, remember that for the past 6-7 years the city has had a LOT of new houses to spread that increase over. Unfortunately, the previous increases were so large they consumed the new housing increases. Spreading this 2% increase over 14% more houses means the average property tax will go down regardless of the increase in value. Here is a graph of the per/person tax and the tax rate over the past 8 years:

As usual, feel VERY free to contact me regarding anything you're curious about or just want to give me your input on.