Property Taxes

Notifications

When you get your proposed (or final) tax statement, it has THREE taxes in it (that are significant) that make up the total; county, city, and school district. Other than your property value, those are independent of each other.

When you get your Valuation notice from the county, if you don't agree with the value of your property, you can (and should) talk to the county assessor and have some good reasoning ready. You can also appeal their value by coming to the board of appeal in April. Your city council decides appeals.

City Property Taxes (numbers)

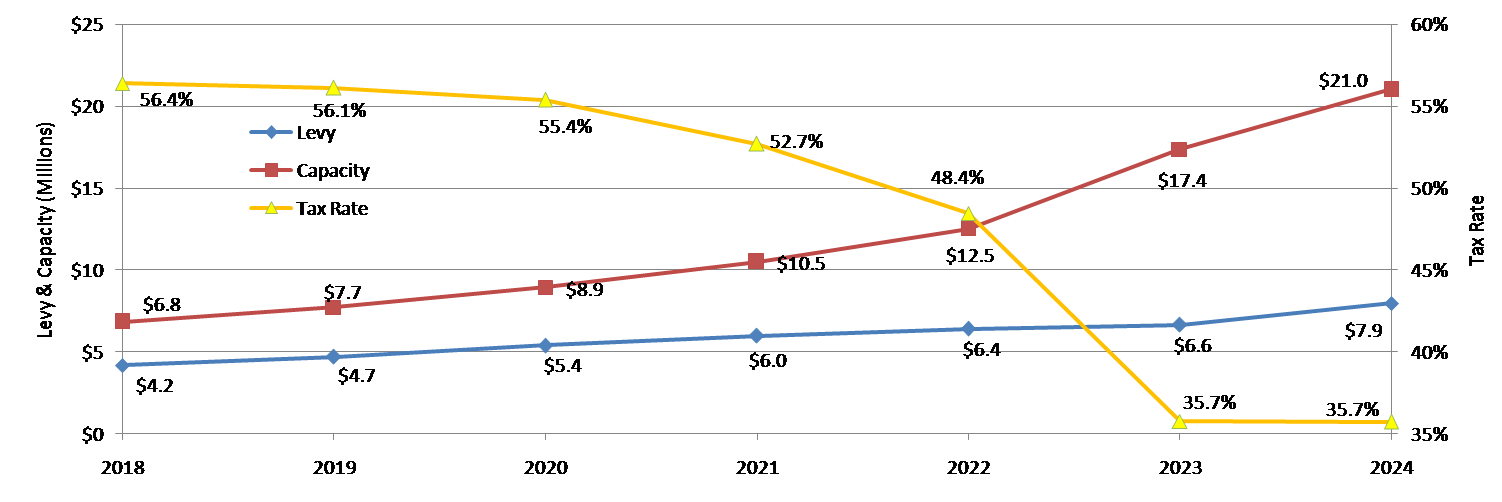

Capacity is proportional to the sum of all the properties in Dayton and is assigned by the county assessors office. It is basically non-negotiable and therefore a fixed number.

Levy is the amount of money the city will get from all property taxes and, if done correctly, is the amount of money needed to run the city for that year. This is key. More houses likely means more support costs for the city, though in Dayton new houses should be significantly more efficient to support. This is the number the council SHOULD set rather than the rate below.

Tax Rate is the result of those two and it's used to calculate (with your property value) your tax bill to the city.

Your City Tax is the tax bill you have after applying the tax rate to your value. Because it's government, politics have gotten into it and how it's applied depends on a lot of things. The basic calculation for residential is:

(Taxable Market Value) x 0.01 x (Tax Rate) = Amount you'll pay the city.

For a $400,000 property: $400,000 x 0.01 x 0.357 = $1428.

Zoning and a high market value will alter that 0.01 number because... government.

Generally, the tax rate is what is used to compare municipalities. Historically, Dayton's tax rate has been towards the top in the entire state. As of 2023, we're much more inline with other cities of our size.

By the way, the previous council had a goal to tackle the tax rate in 2030. i.e. it wasn't a real goal. They were simply satisfied with locking in the rate, then spending all of that extra money coming in from development.

Want to know what your city tax bill would be had you not voted change in? Take your current bill and multiply it by 1.5 (and that's just in one year).

In my opinion, the city shouldn't even KNOW about the capacity. It should spend what it thinks is necessary and that's that.

I've also heard the excuse (even by a previous council member that should have KNOWN better) that our taxes were high due to our debt. Almost all of that debt has been paid for by new development fees rather than taxes . This coming year may challenge that.

A current council member made the claim that we shouldn't have cut taxes, and we should have put more money into the road fund. That council member clearly never looked at the budget. The previous council put $200k into the road fund for 2021. The 2022 levy (the first budget of the current council) RESTORED that $600k to the road fund in addition to reducing the growth of the levy.

As I have mentioned before, additional homes bring in additional needs. For 2024 we increased the overall taxes to bring our staff number more in line with needs (believe it or not 2 of the members wanted to spend far more). For those additional funds we got the following:

- 3 FT Police (1 hired on July 1, 2024)

- 1 FT Fire Assistant Chief

- 2 PT Public Works

- 1 PT Recreation Programs Specialist

- 1 FT Accountant (Hired already but not budgeted for in 2023)

Water Quality

Dayton gets its water from 5 sources:

- The Old Village has its own pump to service the roughly 200 homes there.

- SW area is serviced by Maple Grove.

- North central is serviced by Dayton's north central system.

- Nature's Crossing (south east) is serviced by Champlin.

- Private water systems.

Dayton geology is such that our water (private or central system) is loaded with iron and is fairly hard. So those on private systems know to keep their softener in good shape or their appliances will waste no time turning yellow and start to clog up due to the minerals.

Maple Grove and Champlin treat the iron in their water. Dayton's central and Old Village system do not. None of the public water systems treat hardness.

What complicates this more is the public systems are required to treat the water with various chemicals including chlorine, which also has the nasty side effect of oxidizing the iron. Oxidized iron is not only hard for your softener to pull out, but it also immediately turns the water yellow / brown.

When Dayton initially installed the Old Village and central systems, the city didn't receive many complaints about the water quality (i.e. yellow/brown water). I suspect this was due to the fact that almost all of the homes connecting to it already had softeners and filter systems which took care of the issue. As new homes started coming in, the complaints soon followed. What I've also found talking to new home owners is their perception of the water in their home greatly depends on whether or not their home has a softener and filter system.

Earlier this year the council decided to go forward with a design to add a treatment facility to the central system. At that time the estimate was $4 million. We also received a grant of $4 million from the federal government and $1.75M from the state for it. Recently we were presented with a rough design for that facility which came in at $7.5 million. We were able to remove 0.5 of that since it was clear we didn't need it (a very expensive power generator) so now we're at $7 million.

This treatment facility is scheduled to go online February of 2025.

And just to be clear... this treatment will ONLY remove ion and manganese. It will NOT soften the water. So if you don't want to end up replacing your dish and clothes washer every 5-10 years, you'll want to make sure your home has a water softener.

Bonding (Debt)

In the mid 2000's the city (with a roughly $1M budget) decided to borrow $28M for infrastructure. Some of that made sense to me because we had significant problems with septic systems in the old village and the Donahue Dells area. But, imagine a family with an income of $70k borrowing $2M. And, for an asset they couldn't sell if they got into trouble.

I was also VERY vocal then about the risk they were running.

Well, we got into trouble. Within 2 years of that, the market tanked and housing stopped dead. The city struggled through significant layoffs and service cuts until the housing market picked up again in 2013. I'm not sure where we would have ended up had it been delayed a couple more years.

So here we are, after refinancing that big ugly thing, still with $14M in debt. We are in better shape than we were the first time, but it would still be a massive increase in taxes (or layoffs) if the same thing happened. That debt is currently paid through new development (homes and commercial).

This, and my belief we’re on the edge of a significant recession, Leads me to the position that large bonds aren’t at the top of my todo list.

Fire Station #3

In the mid-70s Dayton decided to put a fire station in the old village (right on top of my favorite library). I was too young at the time to understand why, but I have over the years questioned the logic of putting that one on the edge of the city rather than farther up on Brockton or the river road so it could better service future homes.

Regardless, here we are.

If you look at a map of the city, and then the location of the 2 fire stations we currently have, you'll quickly notice neither is in a good spot. Once we're fully built out, more optimal spots would be somewhere around the central part of North Diamond and somewhere around 117th to 125th.

We can't just "move" a station so that means at some point we'll have to put that south station in and be one of the extremely rare cities of our size to have 3 stations.

From what I gather, everybody on the current council agrees we'll need a 3rd station. The disagreement is when. And while campaigning I found that one of the council members was conveniently leaving out the cost of the station when campaigning for it.

Here's what they're NOT telling you (because they likely have never looked at our budget / levy / debt or to be blunt, thought it through).

According to our fire chief, a new station will run $15 to $20 million dollars. In addition, he wants a new ladder truck in it (at $2+ million). The result is (according to our finance director and assuming only $15M) a median priced home ($450k) will get hit with $450 per year in taxes just to cover that. At worst case ($22M) that number is closer to $660 per house per year. Ouch.

In addition, the city currently has a debt of $14 million. That debt is almost entirely paid by new home fees (not taxes). IF the housing market tanks as it did in 2008, all of that debt will transfer to taxes on TOP of this new debt. That would be a disaster comparable to the 2008 mess.

The reason quicker response times are needed is medical. And medical calls make up 50% of the calls (fire only 5%). Most of the costs we're talking about are aimed at that 5%. A few of us have said we should focus on the 50% in the short term. That means coming up with a facility that will support some form of medical response that allows us to expand later for engine stalls. But so far the fire department has shown no interest in that. It's all or nothing, which is frustrating. I find it hard to believe there's not an affordable short term solution here to almost all of the calls we get.

My proposal is to place the new station timeline at 2028 when we will see a significant amount of commercial/industrial revenue come in from TIFs expiring around then. For information on TIF, click here.

So if you have a candidate come to your door claiming we need a fire station in the next couple of years, ask them to explain where the payments come from and what happens to all that debt (current plus the new) if the housing market tanks. What you'll get is a blank stare.

Development rate

Our rural character defines our city. Almost without exception, residents (in legacy and new homes) emphasize that. I've spent almost my entire life here, and I also love that about our city. There are however, facts that have a great deal of impact on this:

- The Met Council requires us to have an average density of 3 units per acre throughout the city (on buildable and sewer accessible land).

- We have a significant debt incurred years back that is currently paid for by new homes.

- How many times have you heard the phrase "bring in business to bring down taxes?" Well, I'm not sure where that came from but homes work pretty good for that also, IF you don't spend all the money (which we did).

- What do you tell someone that owns fresh land up against the pipe?

By the way, that last bullet works both ways. What do you tell someone sitting on 60 acres that, because they're not scheduled to get that pipe until 2040 or later that they can do nothing with their land other than to try to farm it?

So, there's the dichotomy. One more variable to throw in... It can take years for any process changes to show results. As I write this, it's September of 2022 and all of the homes being built right now were approved in or prior to 2020.

I've made it clear that one of my goals is to diversify our densities. Yes, a perfectly efficient city would have every house sit on the same size 1/3 acre of land. But, that is not what newer or older residents want.

In addition, residents have voiced concerns about the current rate of development. I worry about that also, and with 10% or more homes being built every year, my concern is more along the lines of sudden, unexpected infrastructure problems such as we had with the water supply last summer (and this summer). In addition to the water problems, we have a road problem in the north which we can't build our way out of. The problem is simple; Almost all of the traffic ends up dumping on to or off of county road 12 (River Road). Unfortunately, the county has stated they have NO intention of improving that road for a long time.

The nice thing about developing in the south side of the city is, we can create the infrastructure as we go.

Interchange

While I have a lot of issues with how the interchange was done (ask me if you're curious), I've decided to use this topic to discuss the activity around the interchange.

Many residents ask where our commercial possibilities lie such as "why do I have to go to Champlin to get a coffee?" (ok, so that's my question). For the most part, it's at the interchange. We have set aside roughly 140 acres on the south side of 94 for what is called Mixed Use. What that basically means is commercial / residential. Much of this land is wetlands so that will likely play a large part in where retail activity versus residential ends up. Any residential use in there will be high density (apartments).

The north side is guided more business use such as medical centers, etc. Unfortunately that limits it quite a bit and may have to be changed to something the market is more likely to fill. We did have a request for a truck stop but 3 of us (including me) felt that was not a good use (including the additional police calls) but it's always possible that may come back.

TIF (Tax Increment Financing)

TIF is one of those topics that people know very little about, yet seem to have a hard stance against it. My guess is some of that is well deserved.

TIF is fairly complicated and I don't claim to be an expert, but the overall idea is pretty straight forward. While I think TIF is another way the state corrupts markets, it's here and not using it (judiciously) puts us at a disadvantage.

When an area is developed and an improvement to the property value occurs, the city can declare the area a TIF district. What that means is the city can take ALL of the increased tax revenue (including county and school taxes) from that area and spend it in that area for pretty much anything it wants.

The catch is, there has to be an argument put forth by the city that the development would not occur without the TIF declaration. Not much of a catch.

Here's where I would separate a good TIF from a bad. One of the uses of the TIF proceeds can simply be to give it back to the property owners. I believe this is where you start to drift into bad use. And while our city did this with the Graco development a couple years back (good company, good paying jobs), I wasn't overly enthusiastic about it.

On the other hand, I believe using TIF proceeds to pay for infrastructure that would otherwise be paid for by the tax payer is a good use. An example might be to pay for a road that needs upgrading in the vicinity of the TIF district.

As I stated, TIF is complicated and opinions are all over the map.

Land Use

The term "land use", "guidance", "guided use" all mean the same thing; how the city wants land to be used in the future. That use for every property in the city is defined in what is called the Comprehensive Plan that the city updates every decade or so. The city uses various categories including industrial, commercial, and various types of residential assigned to the properties. That Comprehensive Plan update is required by state law and must be approved by the Metropolitan Council. And because the Met Council says so, all of our residential properties in total must average out to 3 homes per acre.

How a property is categorized can have a significant impact on your property. The people that volunteer for committees such as the comprehensive plan update likely DON'T have your ideology. If you want more say in what happens to YOUR land and YOUR city YOU need to be on these committees or attend the open houses and MAKE YOUR VOICE HEARD.

Back up to topic menu

Roads

Shenanigans

One of the primary local government responsibilities is road infrastructure. For years the Dayton budget only included $250k per year for roads. Everybody knew that wasn't enough and should be around $600k to $800k. The 2020 budget finally moved that to $800k (though they also included a massive amount of other spending along with the new Franchise tax).

So we finally had a more responsible amount targeting roads. Except... an election got in the way. The members on that council that controlled the budget were clearly favoring another member for mayor and at the last budget meeting decided to slash the money going to roads to $200k to bring the tax rate down. In my opinion that was done to give my opponent something to campaign on and was completely irresponsible. I voted for that budget (because it hit my overall target) but I made it clear at that meeting I thought it was clearly irresponsible.

Well, the 2022 budget that the current council approved not only held increases way down compared to that previous council, but it also RESTORED $600k to roads.

Dayton Parkway

The current plan for the Parkway is to run it north from 81 up to 117th. I don't understand why it was connected to 117th where it was rather than more to the east where it wouldn't hit houses, and was very vocal I thought the current routing was a bad idea. But... it's there and we will have to deal with it. Where it goes from there was also (in my opinion) messed up but it looks like we'll be correcting that.

The original plans were to run it from where it connects with 117th at a 45 degree angle to the north end of Fernbrook. Then to have a road run from 113th & Fernbrook north west at a 45 degree to the south end of Zanzibar. That forms what I've called the notorious X. This should have been corrected years ago and we did it in 2023.

My goal would be to simply run it north to connect to the south end of Zanzibar. This will be especially important if a future river crossing goes in (which I'm currently NOT in favor of).

Parks

Like the development or not, it's bringing in a lot of park funding and that's how we're making significant improvements to various city parks.

One of the primary parks (along with some of the regional parks) I've been focused on since being elected to the council is Stephens' park. For a decade after we purchased that park, it sat looking like a wreck until I pushed hard (and that council agreed) to use our growing park fund to actually make that park usable. That was phase 1 which resulted in a park that connects Cloquet Overlook with River Hills' parks (along with a few other amenities).

In addition, we have another phase going in that will bring a number of amenities to the west side of that park including a canoe launch, a separate entrance / exit, and a pedestrian crossing over the ravine.