View the meeting (click to open)

Work session (budget)

Well, this went as I expected (not as I wanted). It would be very easy to be cynical here but I'll try to play fair.

Before I get into this, let me explain the basics of how property taxes work. At the simplest level, the city council decides how much money they want to take from all the properties in the city (the tax levy). That overall number is then allocated to each property according to how much it is worth. If your neighbors property is valued at twice yours, they will pay roughly twice as much in taxes. There are a lot of details that I'm ignoring, but that's the basics. That tax levy is divided by a number called the capacity to determine the tax rate. The capacity is directly related to the value of all the properties in the city. And, each new house adds to that capacity.

The tax rate can be used to calculate individual property taxes. It can also be used to compare against other cities to get a rough idea of what you might be up against if you move there. And... it can be used as a political tool to imply one thing to your constituents while in fact quite the opposite is happening (franchise tax anyone?). In case you're curious, Dayton's tax rate is notoriously high.

To be fair, it makes sense that city spending will increase when there are more houses. It also makes sense there is some level of inflation. But to balance that, all the new houses being put in are FAR more efficient for the city to manage.

My view is that city spending should have some relation to the number of houses in the city, NOT to the value placed on those houses (i.e. capacity).

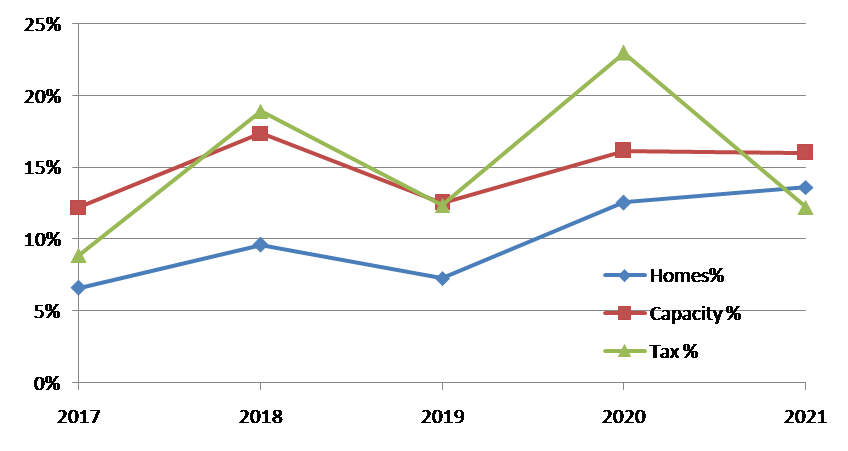

Here's a graph relating increases in taxes, capacity, and number of houses:

You can see in the graph, spending increases are far more associated with capacity increases than housing increases. The 2021 budget was brought in line with the housing increase, but I would argue it was done entirely for election purposes (There are specific reasons I say that, feel free to ask me for details). You'll notice the 2020 budget was a complete blow out of both capacity and housing. And yes, I was the only vote against that budget (and franchise tax). The 2017, 2018, and 2019 budgets were before I was in office.

My goal with this budget was to bring some sanity back to the increases. This city's residents have had a high tax burden for a long time with the reasoning being that we have too few houses for our 25 square miles. Well, we've had a 50% increase in houses for the years in that graph and our effective tax rate (including the EDA and franchise tax) has actually increased!

Here's the bottom line - I want to see a REAL reduction in our spending increases. That doesn't mean a cut. That simply means we need to stop with these double-digit increases.

Unfortunately, this work session didn't give me very high hopes that this council is going to push for much of a change. If you believe you want to see a change in direction, you need to contact members of this council.

Item H: MTL Companies Concept Plan Review

This concept plan was to develop a 44 acre piece of industrial property. It would result in 3 properties; a trailer repair facility, a warehouse distribution facility, and a Curbside Waste facility.

My primary concern was that, given it was up against a residential area, that there be substantial screening protection at that border.

Item I: City Gateway Monument Sign

Given that this was budgeted for, and it came in well under that budget, I was ok with it. I do think we need to look at all the future signs we have scheduled and ask how necessary they really are.

Item J: Closed Session

This session was closed due to discussions with our attorney about an internal matter.

As always feel VERY free to contact me if you have issues you want to discuss, agree or disagree with me on something, have ideas, or whatever...