View the meeting (click to open)

Current Events

- If you or people in your area want to meet and discuss any topics on your mind, reach out to me and I will set up a time to visit.

- If you hear something you're curious to know more about, feel free to contact me!

Item Q (Budget Presentation)

This presentation is tied to item U below. It details a lot of what was accomplished this year and outlines what next year's budget will provide for the city.

Item R (Opus Development)

This further defines a development project on the south corner of 81 and Dayton Parkway. It primarily involves separating the property holding the radio tower from the rest of the property and the site plan.

One of the issues was the county objecting to the parkway access. That access is a no brainer (it's a right in, right out) but the county has guidelines regarding distance between accesses to a county road. At this time the parkway isn't a county road but at some point will be. At that time the access will possibly need to be removed (which could be decades out) and so further details will need to be added as to how that's paid for.

Item S (CUP for Accessory Building)

This item is to allow a detached garage (accessory building) to be built on a property located on a large lot on Balsam Ln. Normally an accessory building like this doesn't come before the council since we changed the accessory building ordinance a couple years ago to allow people more freedom with locations and number. In this case the requested building put them over the total amount of square footage allowed, but the reasoning convinced the council to allow the permit 5-0. The owners were trying to convert the attached garage into living space to care for a handicapped relative.

Item T (Sign Ordinance Amendment)

On almost all properties, the right of way (ROW) is an area about 12 feet or so between your property and the edge of the road and it's owned by the city (or county).

Over the years I've received a lot of complaints about the numbers and sizes of signs put up by the various builders in the city on our (and county) roads in the right of way. This item was the result of the council requesting staff to come up with some solution that helps mitigate this to some degree.

Unfortunately the answer was kind of what I expected. There doesn't seem to be a way to minimize the number of signs a builder can put up. So the answer was to ban all signs other than those mandated by state statute.

This ban applies to local businesses, graduates, birthday parties, garage sales, etc.

I thought it was tossing out the baby with the bathwater but it passed 4-1 with me voting against it.

What this means to you is you cannot place a sign 10-15 feet from the edge of the road into your yard (the right of way).

Item U (Tax Levy and Budget)

This completes the process of determining next year's overall expenditures and setting the tax levy to fund it. Three things come out of this item; The tax levy, the property tax rate, and the major budget items those taxes buy us. Property taxes revolve around this equation:

That's key because if the tax levy is equivalent to the latter amount, properties that have simply increased in value shouldn't (on average) see an increase in the tax payment they make to the city. If the entire amount of capacity is spent, the tax rate may stay the same but on average your tax bill will go up as your property value goes up.

This year we were originally told by the county that our capacity increase was 26%. Of that, 16% was due to new development. I was ok spending that since it should leave current tax payers with the same amount of city taxes they paid last year, but I also knew we did have some additional needs (extra staff) due to Hennepin county reducing the resources they provide and additional staff needs that I became convinced were needed.

So the original request by staff was a 26% increase in taxes. Three of the council landed at about 19%, a A 4th suggested 21%, and the 5th said staff should get whatever they wanted (26%).

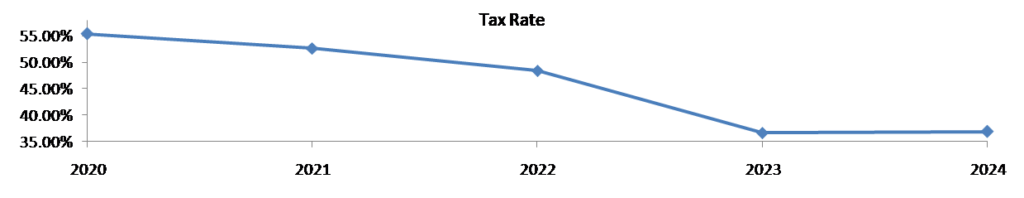

Over time we found out the County had messed up last year's numbers which resulted in the city having to pay the county extra money this year. In order to compensate for that mess we reduced spending a bit more and settled on about 18.5%. Due to that county error, what should have resulted in another reduction of our tax rate, the tax rate stayed the same.

While we didn't continue our tax rate drop trend, keep in mind that just 3 years ago this city's tax rate was at 55% and is now at under 36%.

To understand the impact of that drop, take your current property tax statement and multiply the city amount by 1.5. That's where it WOULD be if you hadn't voted change in a few years ago.

To understand the impact of that drop, take your current property tax statement and multiply the city amount by 1.5. That's where it WOULD be if you hadn't voted change in a few years ago.

We did get a lot of needed staff from this:

- 3 full time hires for the police department

- 1 full time hire for the fire department

- 2 part time hires for the public work department

- 1 full time accountant (hired this year but wasn't funded)

- $750k for capital equipment

While this passed by a 5-0 vote, it's notable that 1 of the council members felt that 18% wasn't enough of an increase and staff should have been allowed to spend what they wanted. You did read that correctly. 18% wasn't enough for that member.

Item V (Long Term Plan)

Nothing surprising in here other than the amount of staff requested for next year was totally unvetted by our administrator and he assured me it shouldn't be anywhere near this many. Assuming that's true and if things go as I suspect they will, we should see another rate reduction next year. But things often don't go as planned...

As usual... PLEASE call me if you have any questions or comments you want to discuss.